Risk, reward and diversification

A common misconception in some circles is that the job of an investment manager is to make money for clients. This is certainly a significant requirement, but it is by no means the be-all and end-all.

The reality is that successful investing is not just a matter of racking up returns. It is also a matter of mitigating situations in which the potential to generate those returns might be negatively affected.

Accordingly, it would be more accurate to say the task at hand is to manage risk and reward alike. In tandem, crucially, it is to manage expectations around these two inextricably linked considerations.

Diversification is key here. It is now more than 70 years since the notion of diversifying investments to enhance performance and reduce risk was first outlined, and the idea has held firm ever since.

As every student of investing knows, the visionary who formalised this concept was Harry Markowitz. He was just 25 when he unveiled his seminal Modern Portfolio Theory (MPT) – a concept deemed so radical at the time that Milton Friedman, his fellow future Nobel laureate, suggested it might fall outside the accepted scope of economics.

Through his research into how risk and correlation affect returns, Markowitz transformed investing almost at a stroke. The long-established emphasis on selecting single, high-yielding stocks without regard for their influence on a portfolio became outmoded and, over time, virtually obsolete.

Subsequent studies built on Markowitz’s formative work, shedding light on the benefits of diversifying not just across but within asset classes. They increasingly demonstrated why it is rarely prudent for investors to put all their eggs in one basket.

Performance and pragmatism

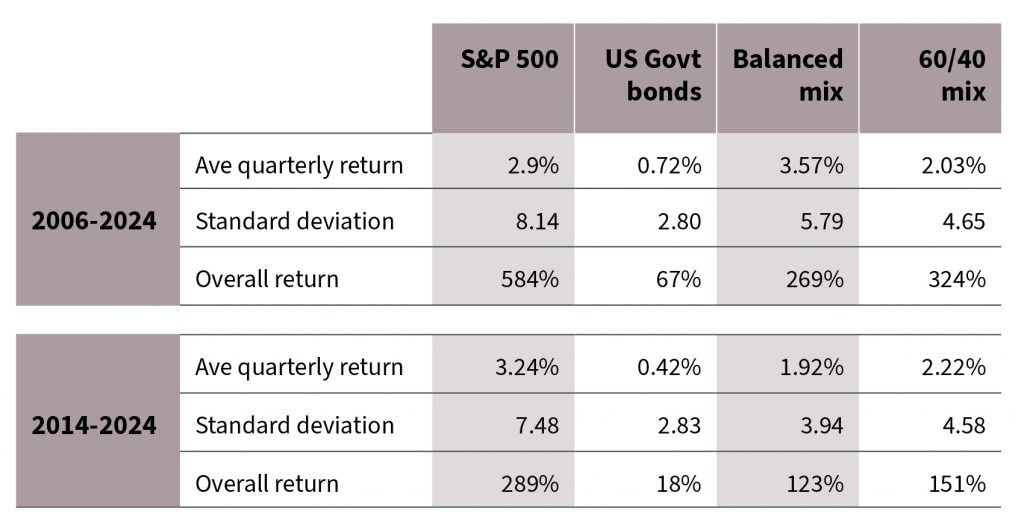

The table below provides a pretty easy-to-absorb illustration. Focusing on investments in US equities and bonds, it highlights diversification’s impact on risk and return during two spells of recent vintage.

You could be forgiven if your gaze is immediately drawn to the bottom lines in the column headlined “S&P 500”. An overall return of 584% between 2006 and 2024, for example, is not to be sneezed at. But the row headlined “Standard deviation” is equally worthy of your attention.

Standard deviation is a widely used measure of market volatility, as derived from the spread of asset prices from their average. It is high when prices move excessively, indicating more risk, and low when prices are more stable, indicating less risk.

We can thus deduce that the aforementioned overall return of 584% entailed relatively high risk. This should come as no great surprise. Generally speaking, it takes a brave soul to invest only in equities – and a still-braver one to invest in only one index.

Happily, as the columns headlined “Balanced mix” and “60/40” show, the wonders of diversification mean it is possible to moderate risk while still enjoying an attractive level of returns. To put it rather more flippantly: it is possible to make money without inviting a nervous breakdown.

There is, of course, the issue of how much diversification is necessary or, better still, ideal. We know the “all your eggs in one basket” approach can be unwise, but what about the other extreme – investing in hundreds or even thousands of stocks, bonds and other assets?

The principal concern in this instance is that a portfolio ends up merely being the market rather than endeavouring to beat it. No-one wants to pay active management fees for what amounts to a closet index-tracker, which is why we aim to diversify clients’ investments to an extent that is both effective and pragmatic.

Diversification’s impact on risk and return

Source: LSEG, February 2025

Long-term thinking

Naturally, every investor has their own unique attitudes to risk and reward. Genuinely understanding and reflecting these has long been one of the most important challenges confronting the financial services industry as a whole.

Numerous profiling tools and techniques are used to gauge individual preferences. Some are more sophisticated than others. In my experience, a true picture is likely to emerge only through close engagement and over time.

There is one fundamental question, though, that all investors might usefully ask themselves. It may sound facile, but it can be remarkably revealing. It is simply this: what is investing?

In grasping for an answer, it might be helpful to first contemplate what investing is not. For instance, it is not gambling. It should not be akin to betting on the turn of a card, the spin of a roulette wheel, the machinations of a one-armed bandit or the outcome of the 3.35 at Sandown Park.

In my opinion, it is also not a case of trying to anticipate or second-guess the short-term consequences of market events. This is the stuff of speculation or, worse still, so-called “gut instinct”. Such exploits are best left to high-frequency traders and other thrill-seekers.

At least in my view, investing should instead be about thinking both tactically and strategically. It should be about building, monitoring and sensibly readjusting a suitably balanced portfolio over a period of years and even decades.

Maybe above all, it should be about accumulating and preserving wealth over the long term. This noble goal is most likely to be achieved if risk and reward are managed successfully and, relatedly, if diversification is practised to best effect.

Tony Conway, Investment Manager

April 2025

Fiske plc. Registered office: 100 Wood Street, London, EC2V 7AN

Member of the London Stock Exchange Authorised and Regulated by the Financial Conduct Authority

Registered in England No 02248663 VAT No. 489 1881 31

Disclaimer

This article is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Fiske plc to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. Fiske plc is authorised and regulated by the Financial Conduct Authority and is a Member of the London Stock Exchange. FCA Register No: 124279.