Volatility, long-term thinking and the Stockdale Paradox

The recent return of Trump-induced market volatility served as a reminder that investors inevitably suffer losses from time to time. So how should they respond? Tony Conway explains how a military hero’s epic ordeal taps into the supreme importance of combining optimism with realism.

James Stockdale was a US Navy Commander during the Vietnam War. In September 1965, during a mission over hostile territory, his jet was downed by enemy fire.

Having parachuted into a nearby village, Stockdale was captured and badly beaten. He was subsequently held at Hoa Lo Prison – the so-called Hanoi Hilton – for the next seven-and-a-half years.

Much later, following his release, he was interviewed by author Jim Collins, who was writing what would become a best-selling book on business management. Having read In Love and War, Stockdale’s memoir, Collins remarked: “If it feels depressing for me, how on Earth did he survive when he was actually there and did not know the end of the story?”

The reason, Collins later discovered, was that Stockdale did know the end of the story. He always believed he would eventually be freed. Despite his situation, he never allowed his conviction to waver.

Asked which of his fellow prisoners had been most vulnerable, Stockdale explained: “They were the ones who said: ‘We’re going to be out by Christmas.’ And Christmas would come, and Christmas would go. Then they would say: ‘We’re going to be out by Easter.’ And Easter would come, and Easter would go. And then Thanksgiving – and then it would be Christmas again. And they died of a broken heart.”

The lesson, Stockdale said, was to strike a balance between optimism and realism. He told Collins: “You must never confuse faith that you will prevail in the end – which you can never afford to lose – with the discipline to confront the most brutal facts of the current reality, whatever they may be.”

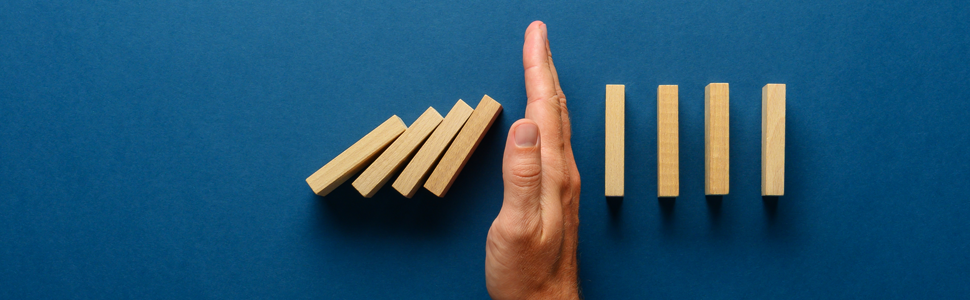

Holding firm in the face of setbacks

In almost every way, of course, investing is not comparable to spending seven-and-a-half years as a prisoner of war. Yet it undoubtedly demands the blend of optimism and realism which Stockdale advocated, particularly over the long term.

After all, it is virtually inevitable that we will all lose money at some juncture. In fact, it is likely that we will all lose money at numerous junctures – and in some instances we may lose quite a lot of it.

Take the turmoil of 2020: as the gravity of the COVID-19 crisis became apparent, many investors saw around a third of the value of their holdings wiped out in just a few days. Similarly, President Trump’s “Liberation Day” announcement on trade tariffs last April sent shockwaves through global markets.

I would argue that investors who held firm in the face of such precipitous declines were true to the ideal encapsulated in the Stockdale Paradox. They were optimistic, in so far as they believed the story would eventually end well, and they were realistic, in so far as they recognised bad things happen.

As Stockdale observed, reality can be brutal. In this context, crucially, one of the most brutal realities of all is that investors are bound to surrender a chunk of their wealth at pretty regular intervals.

What counts is how each of us reacts to such setbacks. We can treat them as heartbreakers and simply give up – or we can treat them as inexorable stumbling blocks and remain focused on the bigger picture.

Reaping the rewards of keeping faith

The first question we tend to ask ourselves when we lose money is whether we will get it back. History suggests we will, but it also suggests we may need to be patient.

This underlines the proven dictum that time in the markets beats timing the markets. As I have written before, the best response to volatility and uncertainty is almost always to keep calm.

It follows that the second question we tend to ask ourselves is how long we might have to wait. This is harder to answer, but it is interesting to note that markets took as much as a quarter of a century to recover from the Great Depression – at least according to some interpretations – and barely a quarter of a year to recover from the collapses of 2020 and 2025.

Why? While the Great Depression was able to meander on in the face of policymaker inertia, more recent shocks have been met with massive stimulus packages and other extraordinary fiscal and monetary measures intended to restore order.

This does not mean we can regard market cataclysms as mere trivialities. Nor should we take successful policymaker intervention for granted. Yet the knowledge that a relatively swift rebound is possible – even probable – gives us good reason not to be spooked, derailed or completely crushed by temporary circumstance.

As Stockdale said, it is a matter of keeping faith in the story’s likely conclusion. This is why the best rule for recovering from losses is exactly the same as the best rule for seeking gains: stay invested. Every investor’s journey commences with an assumption of a happy ending, and it is often only by doubting such an outcome that we genuinely endanger its realisation.

Tony Conway, Investment Manager

January 2026

Fiske plc. Registered office: 100 Wood Street, London, EC2V 7AN

Member of the London Stock Exchange Authorised and Regulated by the Financial Conduct Authority

Registered in England No. 02248663 VAT No. 489 1881 31

Disclaimer

This article is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Fiske plc to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. Fiske plc is authorised and regulated by the Financial Conduct Authority and is a Member of the London Stock Exchange. FCA Register No: 124279.