Atlas Global Equity Income – Monthly Manager Commentary

November 2025

Effective 20th November 2025, Ocean Equity pivoted to a global mandate. The holdings were restructured, and the fund renamed Atlas Global Equity Income. Additionally, the Annual Management Charge (AMC) was substantially reduced to 0.55% from 0.75% for existing and new investors. In the future, it is our intention to close access to this share class for new investors at the reduced rate and to open an additional share class at normalised rates.

The restructured fund has 36 holdings in total. We look forward to discussing these in greater depth over the coming months.

New holding – Atlas Copco

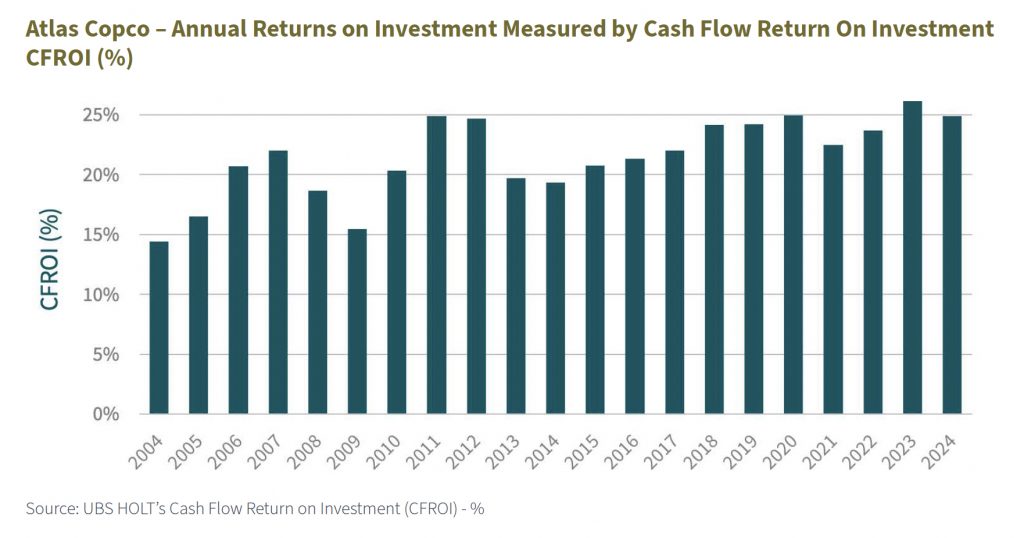

This month we highlight Atlas Copco, a Swedish industrial group that designs, manufactures and services gas compressors, vacuum pumps and other industrial equipment. Founded in 1873, the company has a long track record of attractive returns on invested capital. The chart below, spanning 20 years, illustrates annual returns on invested capital as measured by Cash Flow Return On Investment (CFROI).

While Atlas Copco is cyclical in nature (i.e. its performance is closely tied to broader macroeconomic and capital expenditure cycles in end-markets like manufacturing, construction, automotive and semiconductors), the company’s aftermarket business – servicing equipment and selling spare parts – helps to partially dampen the volatility of returns during downturns.

Main segments

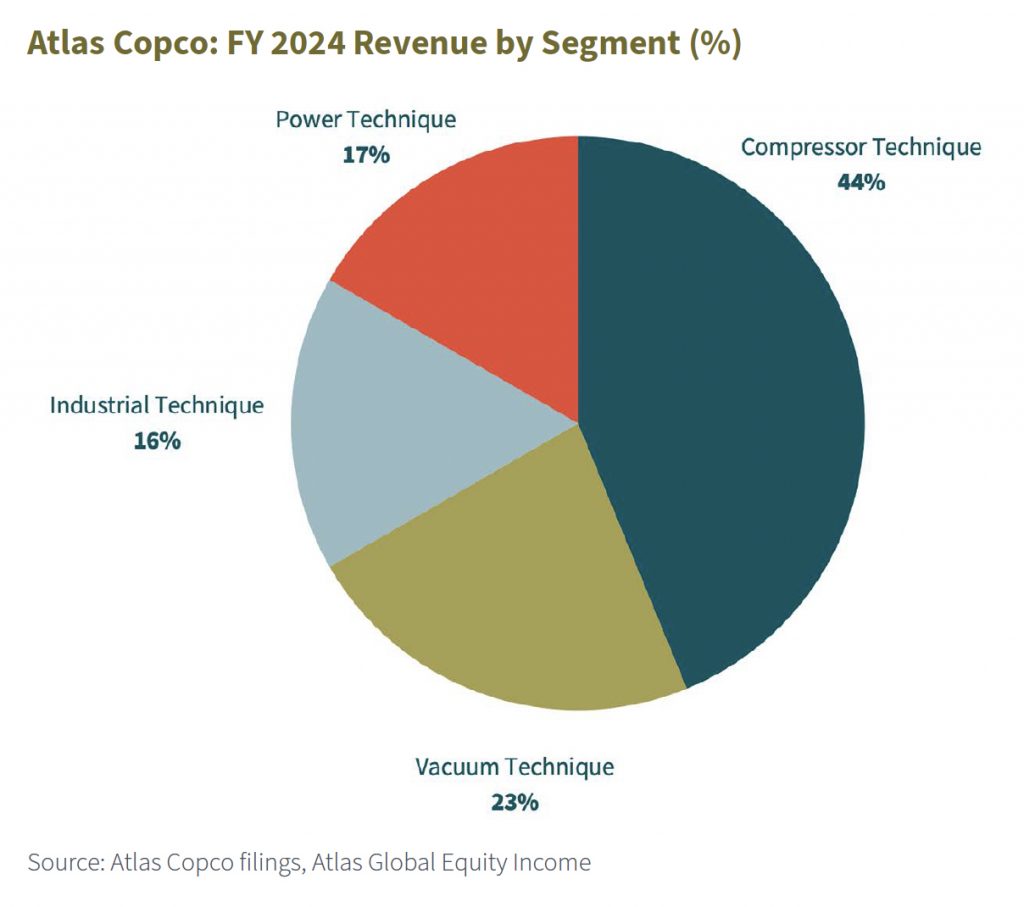

The company has four segments: Compressor Technique, Vacuum Technique, Industrial Technique and Power Technique. Each segment’s share of FY24 revenue is shown in the chart below.

Screenshot

The largest segment, Compressor Technique, accounted for 44% of group revenue and 52% of group operating profit in FY24. As the name suggests, this segment is responsible for designing, manufacturing, marketing and servicing a wide range of industrial compressors (oil-injected, oil-free screw, tooth, centrifugal, piston, etc.) that are used in a variety of sectors.

By way of example, consider Hyundai’s Ulsan plant in South Korea. It is the world’s largest single car factory (producing over 1.5 million vehicles a year), and every step of the automated production line depends on Atlas Copco’s oil-free Zero Risk (ZR) Variable Speed Drive (VSD) screw compressors delivering clean, dry compressed air around the clock. In the body shop, hundreds of welding robots use this air to power precise pneumatic clamps and grippers that hold panels perfectly in place for spot-welding. In the paint shop, robotic arms use fast, stable air pressure to atomise paint and switch colours instantly. In final assembly, automated torque tools and nut-runners tighten every critical bolt with exact force, while pneumatic lifters and conveyors silently move engines, doors and batteries along the line. Finally, at the end-of-line test rigs, compressed-air actuators automatically check brakes, steering and electronics. Reliability of the compressors is essential, because even a brief drop in air pressure would halt the entire factory. Atlas Copco is widely recognised as the market leader in industrial compressors, in large part due to its reputation for the reliability and energy efficiency of its equipment.

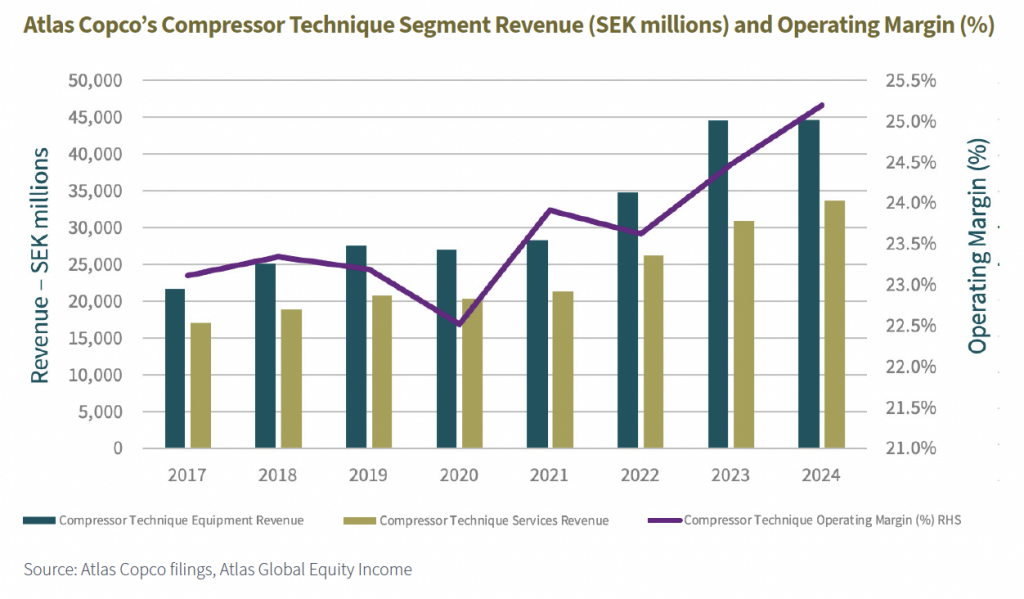

As illustrated in the chart below, the Compressor Technique segment’s revenue is split between Equipment (57% of segment revenue) and Services (43% of segment revenue). The stabilising effect of Services revenue can be seen between 2023 and 2024, when Equipment revenue showed no growth but Services revenue grew 9% year on year. The more compressor units that are installed globally, the more servicing that is required. Also noteworthy is how Atlas Copco has managed to improve the operating margin of the segment to 25.2% in FY24 from 23.1% in 2017.

In summary, the Compressor Technique segment is regarded as the jewel in the crown of the business. It is consistently the largest, most profitable and most stable part of Atlas Copco. As mentioned, it delivers 52% of group operating profit on only 44% of revenues, with the highest margins in the industry (typically 24-26 %). It enjoys a leading market position, driven by products with superior energy efficiency and reliability, and has a high share of recurring service revenue (43%), creating resilient, high-margin cash flows even in economic downturns. It is the cash cow that helps fund group R&D expense (approximately 4% of annual group revenues) and

group capital expenditure, while still funding dividend returns to shareholders (1.9% yield).

Vacuum Technique

The Vacuum Technique segment has also captured our attention. What particularly interests us today is the group’s exposure to the semiconductor capex trend via its wholly owned subsidiary Edwards Vacuum – the market leader in specialised vacuum and abatement equipment that every advanced chip fabrication (fab) plant depends on.

Making a 3 nanometre (nm) or 2 nanometre (nm) semiconductor chip involves hundreds of process steps, many of which must take place in ultra-clean, high-vacuum chambers. Dry etching, deposition and EUV (extreme ultraviolet) lithography all rely on oil-free vacuum pumps that can withstand highly corrosive fluorine-based gases while keeping the chamber particle-free. Once those gases have done their job, the leftover molecules – some with global-warming potential thousands of times worse than that of CO₂ – must be destroyed on-site through sophisticated gas abatement systems.

Edwards pioneered the dry (oil-free) pumps that made modern fabs possible in the 1980s, and today it enjoys the largest installed base of both vacuum pumps and gas abatement units in the industry. Its market leadership is supported by expertise in using specialised and proprietary material solutions for equipment to cope with the harsh gases.

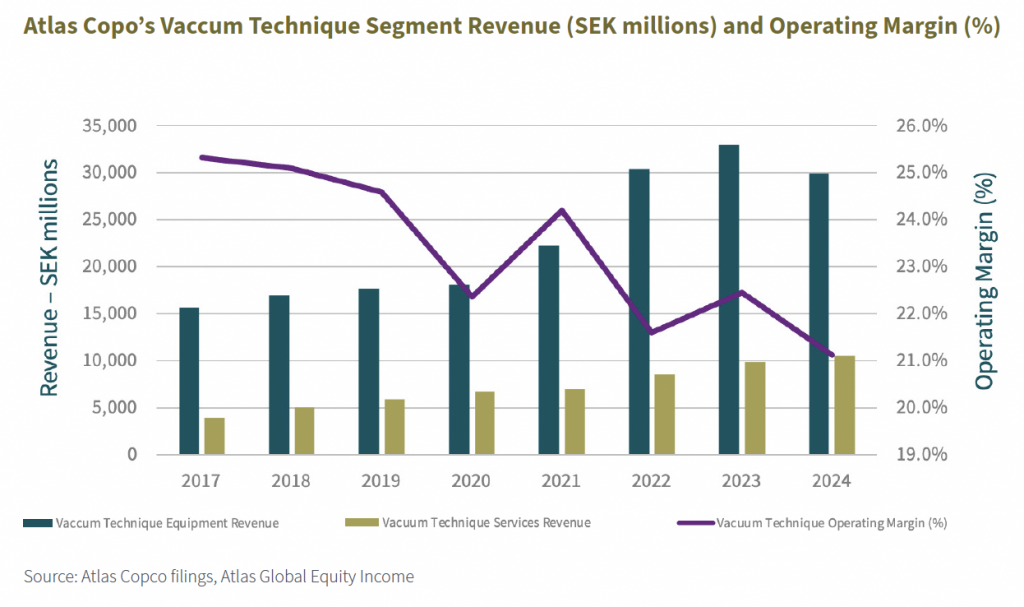

With new fabs opening across the US, Europe, Japan and Taiwan – and AI-driven demand pushing leading-edge capacity additions far into the 2030s – Edwards is well placed to benefit from a multiyear growth tailwind. The subsidiary is reported within Atlas Copco’s Vacuum Technique segment. As shown in the chart below, Equipment revenue for the Vacuum segment has approximately doubled between 2017 and 2024, with most of that growth coming during the global semiconductor shortage that started in 2020. After significant growth, the segment’s exposure to the cyclicality of the semiconductor sector can be seen in 2024 as Equipment sales fell by 9.2%. However, note the steady increase in Services revenue in 2024, despite the downturn. As of FY24, only 26% of segment revenue is from Services, with 74% from Equipment sales – offering significant opportunity for Services revenue to grow in the future.

Unlike the Compressor Technique segment, Vacuum Technique has struggled with declining operating margins during this period of strong growth. R&D expenses, currency effects and restructuring charges have played a part.

Despite the recent cyclical revenue and operating margin declines, we have a favourable view of the long-term structural trend in semiconductor production and see Atlas Copco’s market-leading products and services as well placed to benefit. It is the kind of ‘picks-and-shovels’ exposure to a long-term structural growth trend which we are happy to own in the Atlas Global Equity Income portfolio.

Michael Foster, Fund Manager and Roger Breuer, Analyst – Atlas Global Equity Income

November 2025

………………………

| AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY |

| MEMBER OF THE LONDON STOCK EXCHANGE |

| NOT FOR DISTRIBUTION IN THE U.S.A. |

This factsheet has been issued by Fiske plc on the basis of publicly available information, internally developed data and other sources believed to be reliable and accurate. No representations or warranty, expressed or implied, is made nor responsibility of any kind is accepted by Fiske plc, its directors or employees either as to the accuracy or completeness of any information stated in this factsheet. Any opinions expressed (including estimates and forecasts) may be subject to change without notice. This document is not intended as an offer to buy or sell the fund nor as a personal recommendation. Fiske plc, or any of its connected or affiliated companies or their employees, may have a position or holding or other material interest in the fund concerned or in a related investment, or may have provided within the previous twelve months, significant advice or investment services in relation to the investment concerned or a related investment.

Investors must be aware of the risks associated with investment in this fund. Full details of the Atlas Global Equity Income Fund, including risk warnings, are published in the Prospectus and Key Investor Information Document (KIID). The fund may not be suitable for all investors and if you are in any doubt whether the fund is suitable for you, advice should be sought from a suitably qualified professional advisor. The value of the fund and the income derived from it can go down as well as up. Investors may not get back their initial investment. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realised. Securities denominated in foreign currencies may see their value fall as a result of exchange rate movements. Any comments contained in this factsheet are intended only for the use of the individual or entity to which it is addressed and may contain information which is confidential and may also be legally privileged. If you have received this document in error, please telephone the Compliance Department on +44 (0)20 7448 4700. Fiske plc FCA Register No: 124279