Atlas Global Equity Income – Monthly Manager Commentary

January 2026

A number of holdings issued earnings reports in January. Texas Instruments reported its Q4 2025 earnings and provided an optimistic outlook, emphasising recovering demand in industrial and automotive sectors and 70% year-over-year growth in data centres. Microsoft reported strong Q2 FY26 results, including approximately 39% revenue growth in its Azure cloud services, but disappointed some market participants. LVMH reported its FY earnings, with 2025 revenue at €80.8 billion – down 1% organically. CEO Bernard Arnault suggested it was hard to predict a short-term rebound in the face of geopolitical and economic volatility, adding: “2026 won’t be simple.” During January we sold our holding in The Magnum Ice Cream Company (TMICC), which we received as a spin-out from our holding in Unilever.

Featured holding – Halma plc

This month we highlight FTSE 100 constituent Halma plc. The name offers little insight into the business, but brush past it and you find a fascinating company that we believe is well worth discovering.

Origins

Halma traces its roots back to 1894, when it was incorporated in Scotland as the Nahalma Tea Estate Company Limited and operated plantations in what was then Ceylon (now Sri Lanka).

The company shifted its focus to rubber production in 1937, but in the early 1950s, following Sri Lanka’s independence in 1948, the government implemented land reform policies that nationalised foreign-owned plantations, including Nahalma’s rubber estates. With these assets lost, the British-based business re-oriented as an investment and industrial holding company focused on other ventures. In 1956, reflecting this shift, it changed its name to Halma Investments Limited.

After listing on the London Stock Exchange in 1972, the business formally registered as a public limited company in 1981, eventually adopting the name Halma plc.

Halma today

Halma plc now owns approximately 50 technology companies operating in highly specialised niche markets, including fire and gas detection, environmental monitoring and medical diagnostics. Products tend to be mission-critical and technically complex and face limited direct competition due to high barriers to entry. These niches often benefit from the tightening of global regulations on safety, health and environmental standards – a structural trend that drives sustained demand and supports long-term growth.

The hidden gem – Avo Photonics

Buried within Halma’s Environmental & Analysis (E&A) segment is a remarkable business called Avo Photonics. We regard this as a company that is growing too big to ignore.

Avo Photonics’ origins within NASA

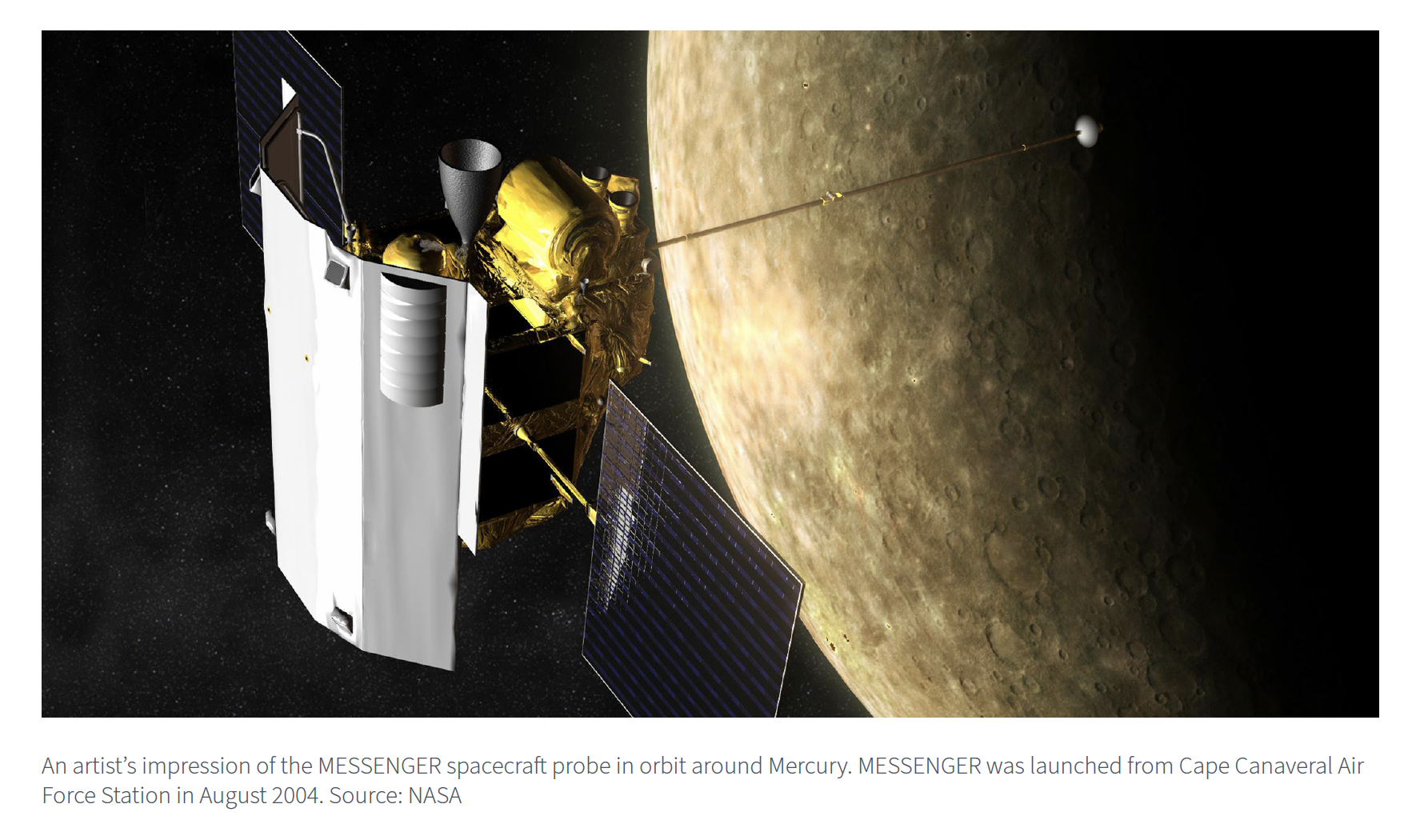

In the 1990s NASA pioneered a flexible approach to developing rugged, high-powered space lasers by creating the Space Lidar Technology Centre (SLTC), based close to the Goddard Space Flight Centre, near Washington DC. Modelled on Lockheed Martin’s Skunk Works, which produced the U-2 spy plane and F-117 stealth aircraft, this small, autonomous team of up to 20 laser experts operated with minimal bureaucracy to innovate in photonics. Led by Dr Joseph Dallas and Dr Robert Afzal, the team successfully delivered key flight lasers for NASA’s ICESat satellite, launched in 2003, and MESSENGER probe to Mercury, launched the following year.

Shortly after these specialist projects were delivered, funding and further work dried up – forcing the team to disband in the early 2000s. Dr Dallas took the lessons he had learnt and founded Avo Photonics in Horsham, Pennsylvania, creating a private company offering contract design, prototyping and production of photonic systems for aerospace, defence, medical and other sectors. This private company was no longer solely dependent on NASA for business.

Halma’s acquisition of Avo Photonics

Halma acquired Avo Photonics in July 2011 for an initial cash consideration of $9 million (£5.6 million), with up to $11 million additional contingent earn-out based on profit growth. The purchase strengthened Halma’s photonics portfolio by adding advanced manufacturing capabilities and offered synergies with existing businesses like Ocean Optics.

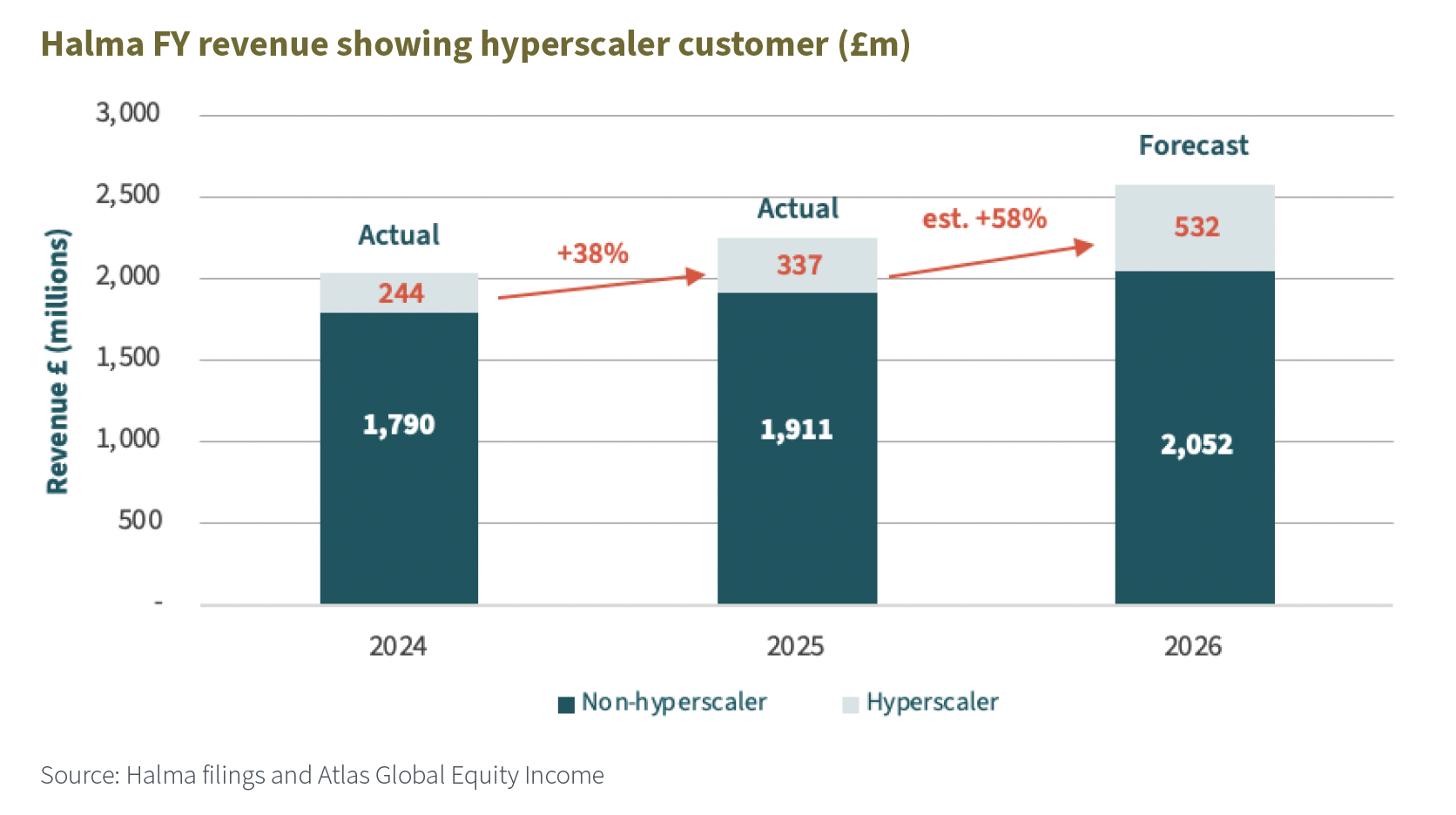

By 2024 Halma’s revenue from one customer alone was greater than 10% of group revenue, and IFRS accounting rules required a disclosure. This customer was one of Avo Photonics’, and in FY24 it was responsible for 12% of group revenue. By 2025 the customer was described by Halma as a “hyperscaler” technology company. A hyperscaler is a large-scale cloud service provider that builds and manages large, distributed data centre networks.

What is photonics?

It is important at this point to define photonics. It is the science and technology of working with light – specifically, tiny particles, called photons – to generate, control, transmit, detect and process information or perform tasks.

The field of electronics uses electrons – tiny, charged particles flowing through wires, transistors and chips – to carry signals, compute, store data and power devices. We can think of photonics as similar to electronics, with photons travelling through optical fibres, lasers, waveguides and detectors to do a similar job.

Photonics originated in demanding applications like space exploration and long-distance telecommunications (where there are advantages in light’s speed and low signal loss transmission), but advances in lasers and integrated circuits have made it practical for other sectors. These include medical imaging, manufacturing, sensing and, more recently, high-speed data centres powering artificial intelligence (AI).

To understand why the “hyperscaler” mentioned above is spending approximately half a billion pounds this year with Halma’s photonics division, we need to appreciate the challenges of cutting-edge data transmission.

The “copper wall” problem in data centres

AI relies on the ability to move increasing amounts of data around a data centre, from server to server and from rack to rack. Copper cables continue to dominate these data highways, as they offer the best combination of low cost, minimal power use and high reliability for short-distance links.

In dense AI and high-performance computing setups, servers, GPUs and switches connect within the same rack or adjacent ones (typically under five metres) by using copper cables that deliver aggregate speeds up to 800 Gbps (gigabits per second) or more with near-zero latency and no need for signal conversion. These cables consume almost no extra power, helping control electricity and cooling in energy-intensive facilities. This makes copper the current default for intra-rack networking, where it remains cheaper and simpler to deploy.

However, as data centres scale up for massive AI workloads and try to increase transmission speeds, this heavy dependence on copper is creating a growing “copper wall”. The core issue is per-lane speed. As mentioned previously, bandwidth for these copper cables can exceed 800 Gbps, but they use multiple lanes within each cable to do this. Increasing speeds further by pushing data transmission beyond approximately 100-112 Gbps per lane causes severe weakening of the signal (signal attenuation) and increased electromagnetic interference. These effects dramatically shorten copper cable’s reach and limit density of cables as a result of a problem known as crosstalk, making it hard to scale to ever-larger clusters without unacceptable error rates.

This is where moving away from electrons running through copper cables to photons travelling through fibre optics comes in.

Optical modules provide a partial solution

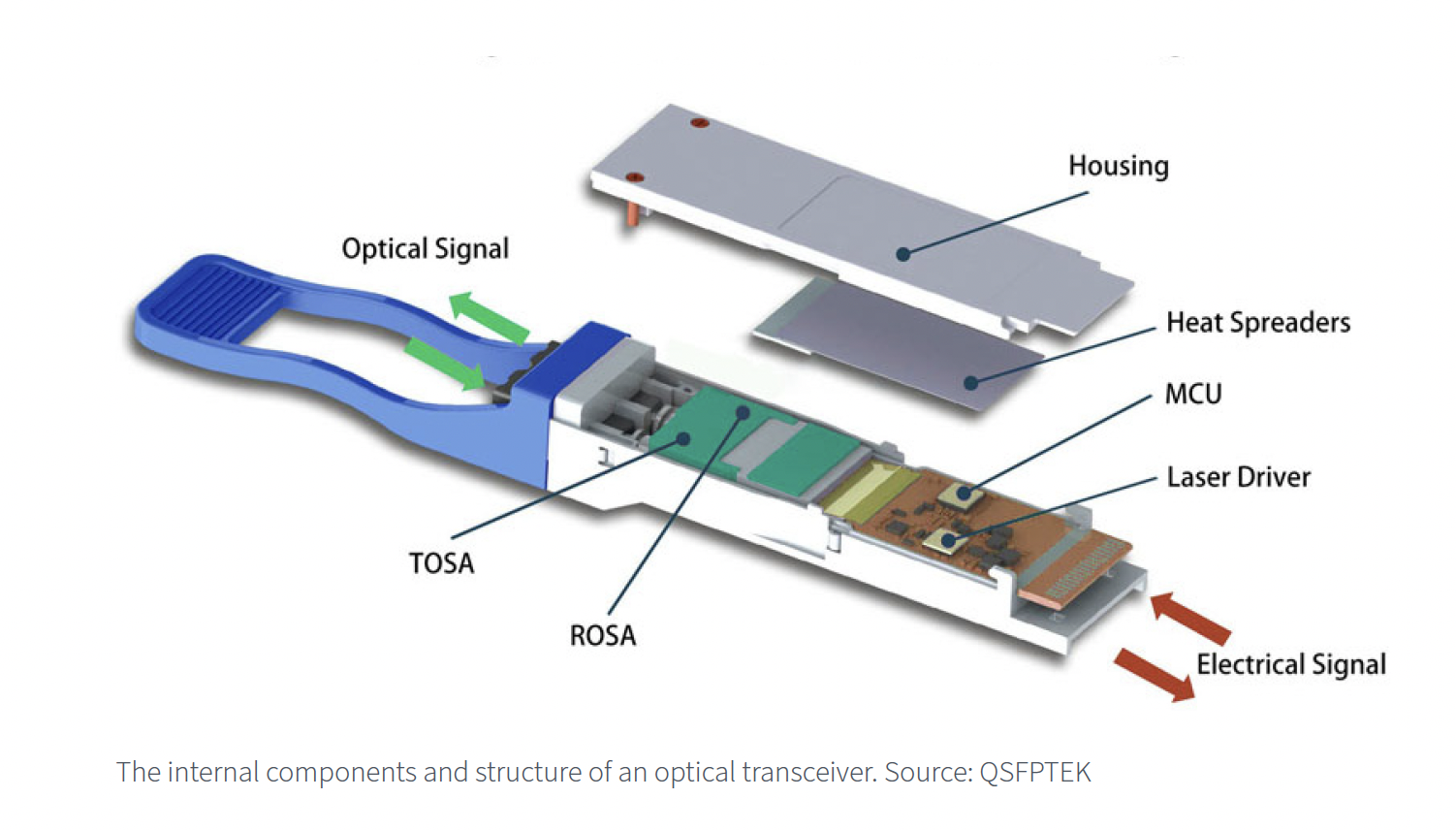

Optical pluggable modules – small devices that plug into servers – solve the problem of moving data “inter-rack”. They use fibre optics to carry data over longer distances (tens to hundreds of metres) with minimal loss and no electromagnetic interference. However, the trade-off is costly.

First, each optical module needs extra equipment to convert the signal from electrical to optical. On top of that, each module requires 10-15 watts of power for this conversion, adding substantial power consumption and heat across thousands of ports. In power-constrained hyperscale environments this overhead increases cooling needs, operational costs and the overall energy requirement – far from ideal.

The image below shows an optical pluggable module. The assortment of labels and acronyms is not particularly important here. Focus on the red arrows, showing where the electrical signals go in and out, and the green arrows, showing where the optical signals go in and out.

Co-packaged optics (CPO) – a more efficient solution

Co-packaged optics (CPO) represent the likely future. They integrate the optical engine directly on to the chip package next to the networking chip or processor, avoiding the need for long board traces and separate pluggable transceivers. In simple terms, CPO embeds the light-conversion technology right beside the silicon, shortening electrical paths dramatically. This slashes power use by 60-70% (often to 4-6W per port), cuts latency, boosts port density for terabit-scale fabrics and improves thermal efficiency. As AI demands push towards gigawatt facilities, CPO overcomes copper’s per-lane speed barriers for sustainable, high-performance scaling.

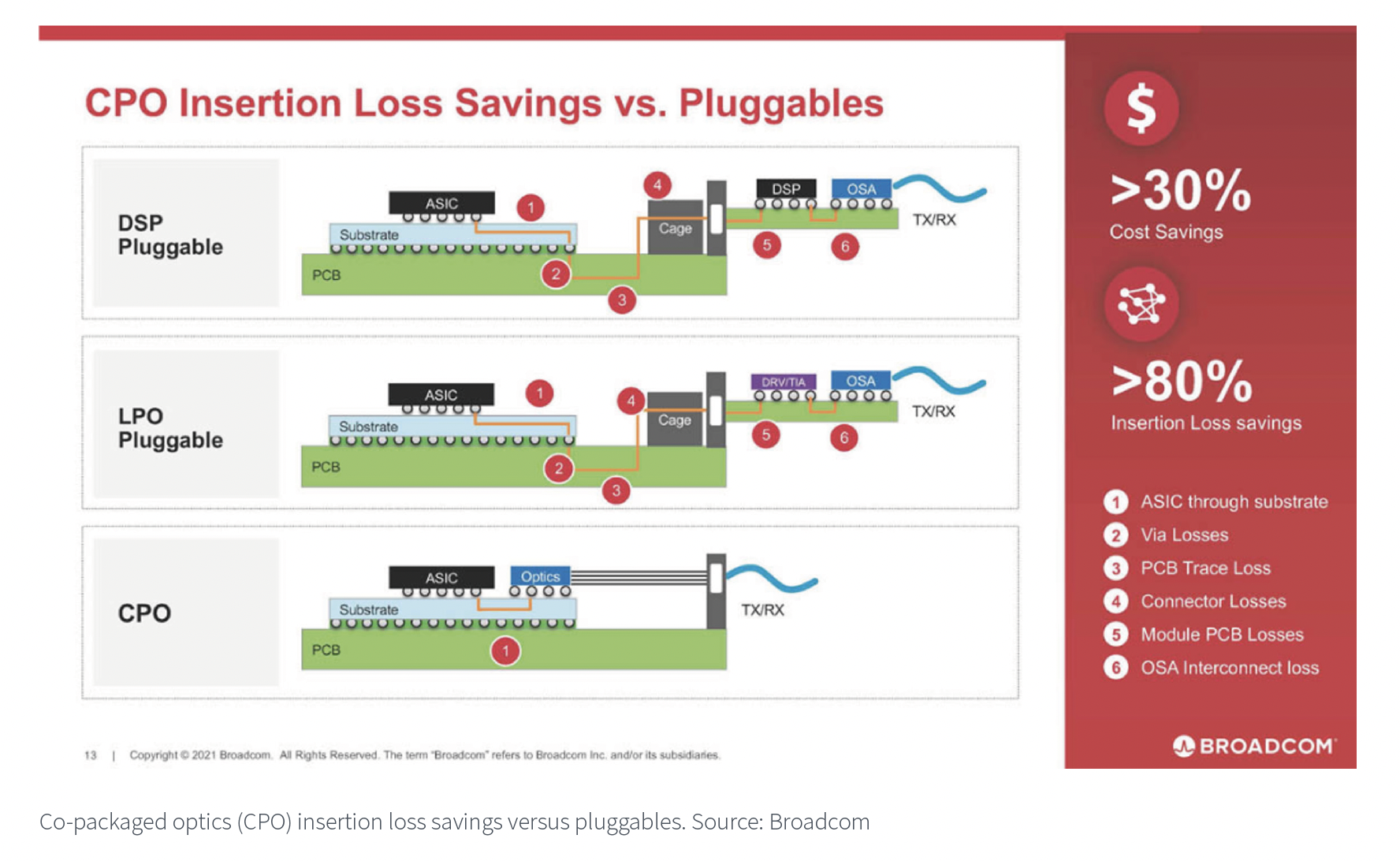

The slide below – from Broadcom, a market leader in networking chips – highlights the advantage of CPO versus optical pluggable modules. Again, there are various acronyms. DSP (digital signal processor) pluggable and LPO (linear pluggable optics) pluggable are simply two different types of optical modules. Insertion losses is a simple way to measure how much signal power gets lost when something is added into the path of a signal.

The slide highlights how placing the optics next to the networking chip (ASIC – application-specific integrated circuit) saves more than 80% in insertion losses from all the other equipment and also saves over 30% from not needing the other components.

Nvidia also pursuing co-packaged silicon photonics

At the 2026 staging of CES, an annual trade show organised by the Consumer Technology Association, Nvidia CEO Jensen Huang highlighted copper’s continued role while emphasising the shift to optics. Although he described large-scale AI racks still using “two miles of copper cables”, implying that copper remains an effective option over short distances, he showcased Spectrum-X Ethernet Photonics switches with co-packaged silicon photonics as a breakthrough that could be used to “scale out thousands of racks into an AI factory”. A concurrent press release from Nvidia boasted: “Nvidia Spectrum-X Ethernet Photonics switch systems deliver 5x improved power efficiency and uptime.”

What exactly does Avo Photonics do?

Avo Photonics is a contract design and manufacturing business. It describes itself as a “pure service company” that offers “contract photonics manufacturing” while also assisting clients with design and development.

The company focuses exclusively on custom, private-label opto-electronic and photonic products, providing full-cycle support from initial design and prototyping through to scalable US-based production. It serves key markets such as medical, industrial, military/aerospace and communications.

Avo Photonics’ core strengths include strict confidentiality, with clients retaining full ownership of intellectual property (IP); expertise in assembly and packaging (such as hermetic sealing, fibre coupling and die bonding); and strong expertise in certifications for industries like medical and defence.

Unlike its competitors in the photonics space, Avo does not develop or sell its own branded products and does not specialise in high-volume silicon photonics foundry services. It operates purely as a behind-the-scenes partner, helping clients bring their custom photonic and opto-electronic designs to market reliably and at scale in the US.

Long-term relationship

Avo Photonics’ custom service has led to a long-term relationship with a “hyperscaler”, the company’s largest customer. Halma’s interim 2025/2026 earnings announcement commented: “There was very strong growth in the Optical Analysis subsector, primarily driven by photonics, reflecting increased demand from a long-standing customer, a ‘hyperscaler’ technology company, for critical solutions that support the ongoing development of its data centre capabilities. This customer accounted for 19% of Group revenue in the period (H1 24/25: 14%). We expect a continued benefit from the premium growth in photonics in the second half of the year.”

An analyst presentation by Halma in November 2025 suggested that Avo Photonics’ custom services expertise had “led to a period of over 10 years of working closely with their hyperscaler customer”.

Halma’s interim earnings for the six months ending September 30 2025 implied that revenue from the hyperscaler amounted to approximately £235.1 million (19% of group revenue). This is +56% versus the H1 results from the same period a year before, when hyperscaler revenue was described as responsible for 14% of group revenue.

Halma also remarked: “We now expect to deliver, for the year as a whole, mid-teens percentage organic constant currency revenue growth, including a continued benefit from the premium growth in photonics within the Environmental & Analysis Sector, and an Adjusted EBIT margin (excluding the one-off profit in the first half) of around 22%. This is supported by our Group order intake, which remains ahead of both revenue in the year to date and the comparable period last year.”

Based on 15% revenue growth for FY25/26 group revenue and given the comments about order intake, if we assume stable growth expectations for the company’s Safety and Healthcare segments, it seems reasonable to expect FY revenue from the hyperscaler alone to be in excess of half a billion pounds.

Tailwind from hyperscaler capex

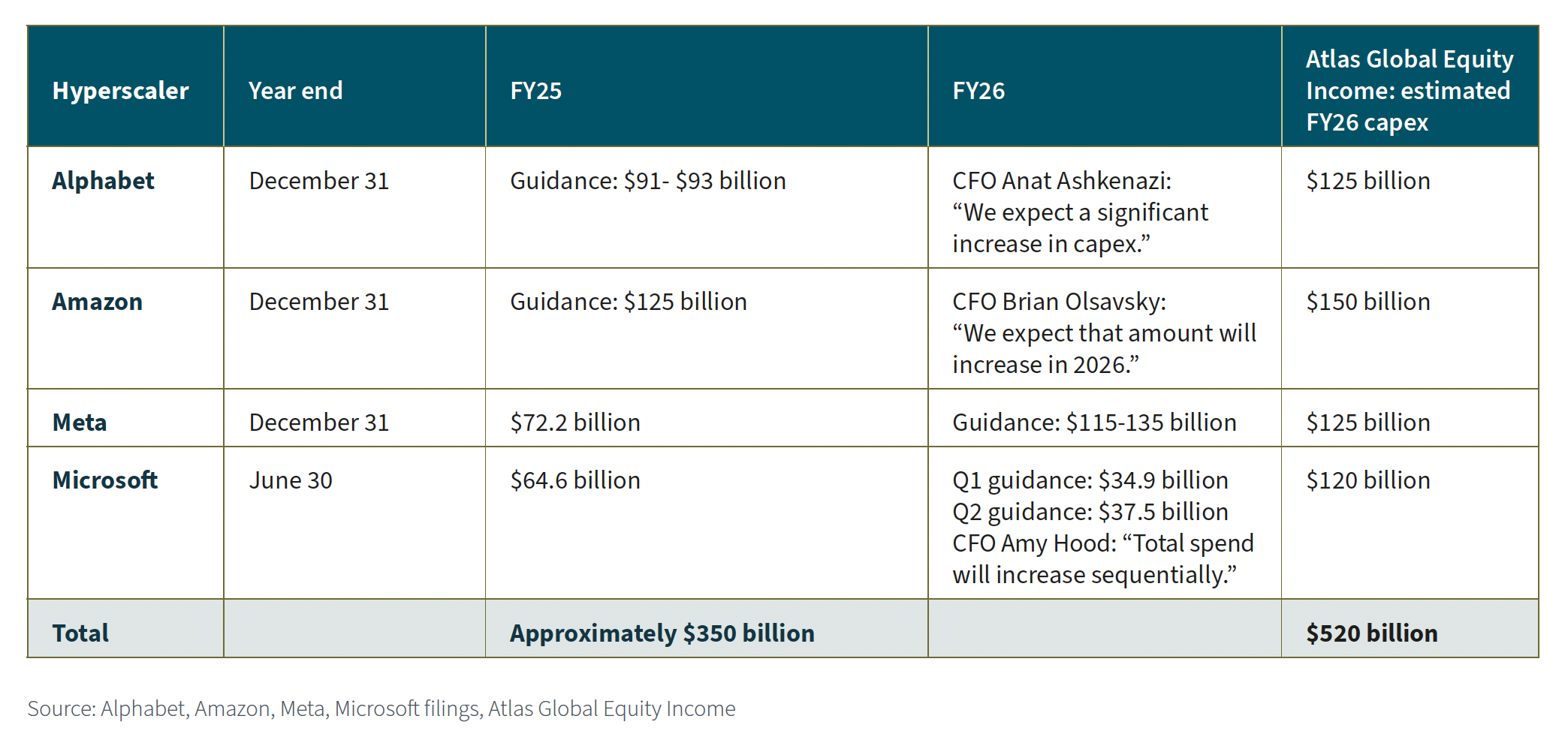

Capex investment for data centres provides a huge tailwind for Halma’s photonics business. Four of the largest North American-based hyperscalers – Alphabet, Amazon, Meta and Microsoft – collectively invested approximately $350 billion in FY25. The vast majority of this spending was allocated to new data centres.

These four companies have all indicated increases to this spending in FY26. In fact, Atlas Global Equity Income forecasts FY26 capex investments of approximately $520 billion (+49% year-on-year).

Conclusion

Halma has a history that dates back well over a century. Today the company owns approximately 50 technology companies operating in highly specialised niche markets. Buried within its Environmental & Analysis (E&A) segment is Avo Photonics, a business at the cutting edge of technological change within data centres.

Avo Photonics is addressing the challenge of moving data accurately and at high speed without the need for excessive amounts of power. Harnessing light – or, more specifically, photons – appears to offer a solution. The company’s hyperscaler client has worked with Halma’s subsidiary for over a decade and this year is likely to account for over £500 million of revenue. This is a significant revenue driver hidden within a FTSE 100 constituent.

Michael Foster, Fund Manager and Roger Breuer, Analyst – Atlas Global Equity Income

January 2026

………………………

| AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY |

| MEMBER OF THE LONDON STOCK EXCHANGE |

| NOT FOR DISTRIBUTION IN THE U.S.A. |

This factsheet has been issued by Fiske plc on the basis of publicly available information, internally developed data and other sources believed to be reliable and accurate. No representations or warranty, expressed or implied, is made nor responsibility of any kind is accepted by Fiske plc, its directors or employees either as to the accuracy or completeness of any information stated in this factsheet. Any opinions expressed (including estimates and forecasts) may be subject to change without notice. This document is not intended as an offer to buy or sell the fund nor as a personal recommendation. Fiske plc, or any of its connected or affiliated companies or their employees, may have a position or holding or other material interest in the fund concerned or in a related investment, or may have provided within the previous twelve months, significant advice or investment services in relation to the investment concerned or a related investment.

Investors must be aware of the risks associated with investment in this fund. Full details of the Atlas Global Equity Income Fund, including risk warnings, are published in the Prospectus and Key Investor Information Document (KIID). The fund may not be suitable for all investors and if you are in any doubt whether the fund is suitable for you, advice should be sought from a suitably qualified professional advisor. The value of the fund and the income derived from it can go down as well as up. Investors may not get back their initial investment. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realised. Securities denominated in foreign currencies may see their value fall as a result of exchange rate movements. Any comments contained in this factsheet are intended only for the use of the individual or entity to which it is addressed and may contain information which is confidential and may also be legally privileged. If you have received this document in error, please telephone the Compliance Department on +44 (0)20 7448 4700. Fiske plc FCA Register No: 124279