Compound growth: the holy grail of investing

In Monty Python and the Holy Grail, which marks its 50th birthday this year, King Arthur’s quest for the eponymous treasure is thwarted at every turn. The film’s devotees will recall how raspberry-blowing French knights, anarcho-syndicalist peasants and a killer rabbit – among many others – frustrate his efforts.

Is the holy grail of investing any easier to find? We believe so, but the search still demands patience and persistence – even in the absence of cow-flinging catapults, the Gorge of Eternal Peril and life-or-death questions about the airspeed velocity of unladen swallows.

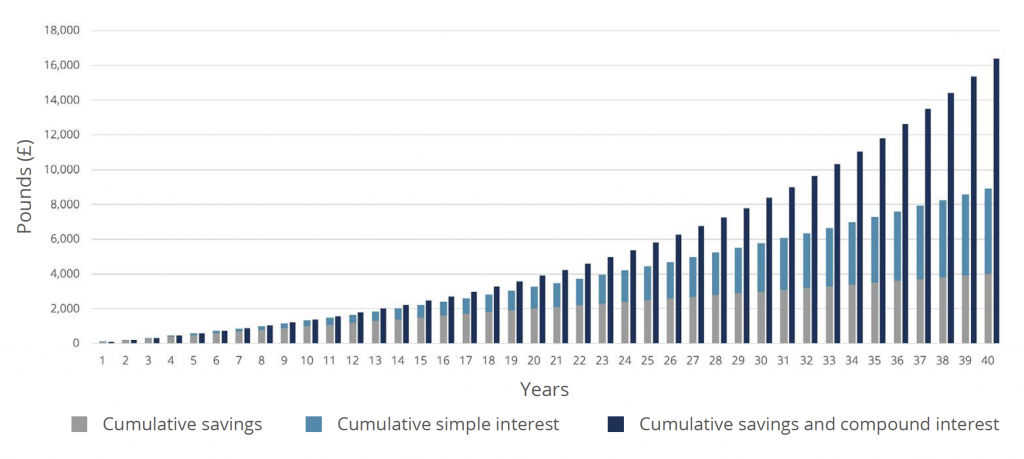

In our view, compound growth is the investment world’s ultimate prize. In the same way that compound interest on savings can offer a notable financial advantage over the long term, equity investments that are able to “compound” over time are of obvious appeal.

So how do we identify the businesses that might be capable of this feat? Maybe the simple answer would be to look no further than the companies that have consistently grabbed the lion’s share of headlines over the past few years – the so-called “Magnificent Seven”.

With the artificial intelligence (AI) boom taking off in earnest, the argument for investing predominantly – if not exclusively – in Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla gained ground again last year. Yet investing is very seldom so straightforward.

Each of these companies suffered a wobble at some point in 2024[1]. Come year’s end, the top performers were spread across a range of sectors and industries – among them financials, aerospace, energy and airlines[2], [3].

As it happens, the Ocean Equity Fund has owned Alphabet and Microsoft since its launch. Trillion-dollar behemoths embedded at the vanguard of radical disruption do possess a certain allure, after all. But there are plenty of “compounders” beyond the usual clique of US tech titans.

In widening the search, it’s vital to have both an investment philosophy and an investment process. Without these, in all likelihood, investors are doomed to flit from one strategy to another, drawn mainly by anecdotal evidence or fleeting successes – not unlike the hapless Arthur, you might think.

Saving £100 each year with annual interest rates at 6%

Source: Ocean Equity Fund

Our investment philosophy is formulated around people, products and services. The right people drive businesses for the betterment of society, while the right products and services deliver good outcomes for as many stakeholders as possible.

By extension, our investment process centres on companies that exhibit these attributes – and, crucially, which are likely to continue to exhibit them over a considerable period. Typically, such businesses have high, sustainable and expanding profit margins, little or no debt and robust competitive positions.

The last of these merits further explanation. An ability to maintain an edge over would-be rivals is essential to a company’s capacity to reinvest excess cash at attractive rates of return and so fuel that all-important compound growth.

One way in which compounders might keep competitors at bay is through adaptability. This doesn’t necessarily mean they have to be forever at the cutting edge of technology. Look at miniature wargames manufacturer Games Workshop, which survived the onslaught of digitisation but has now embraced it to reach a bigger audience by licensing its intellectual property via a new partnership with streaming giant Amazon.

Brand can be another key differentiator. Companies that have built their names and reputations over the course of decades – or even centuries – have a cachet that relative newcomers can’t match. Louis Vuitton, which was established in 1854 and has proved able to skilfully tweak and update its offering ever since, fits this bill.

Compounders can also stave off the threat of competition by playing a critical role within the broader ecosystem of an industry or sector. Take RELX, whose proprietary databases are used by numerous professions that would struggle to get the same wealth of information elsewhere.

These and other “economic moats” – to use a phrase reportedly coined by Warren Buffett – might preserve a business’s pre-eminence for many years. They feed into the idea that investments in high-quality companies, coupled with a supportive economic backdrop, can reward shareholders over the long term.

We use a combination of fundamental analysis and direct engagement to select the compounders that comprise the Ocean Equity Fund. By blending quantitative and qualitative insights, we construct a sensibly diversified portfolio of around 30 to 40 holdings.

Our laser focus on compound growth may not allow us to follow Arthur across the Bridge of Death and to the gates of Castle Aarrgh – less still to beat him to his own holy grail. But we firmly believe it can help clients benefit from what we regard as the most significant phenomenon in the sphere of long-term investment.

Michael Foster is Lead Portfolio Manager of the Ocean Equity Fund.

March 2025

[1] See, for example, Barron’s: “Mag 7 stocks are dragging down the market”, November 21 2024 – https://www.barrons.com/livecoverage/stock-market-today-112124/card/mag-7-stocks-are-dragging-down-the-market-3XMfcTlWeJ8Jgqxq8Qak.

[2] See, for example, CNBC: “Financials are the best-performing stocks of 2024. Here’s one corner that could do especially well” – November 27 2024 – https://www.cnbc.com/2024/11/27/financials-are-best-performing-stocks-of-2024-one-corner-could-outperform.html.

[3] See, for example, Yahoo: “With 2024 almost over, there are the five top-performing stocks in the S&P 500”, November 6 2024 –https://finance.yahoo.com/news/2024-almost-over-5-top-010000989.html; and Motley Fool: “Revealed! The 10 top-performing FTSE 100 shares in 2024”, August 20 2024 – https://www.fool.co.uk/2024/08/20/revealed-the-10-top-performing-ftse-100-shares-in-2024/.

………………………………………………………

The Ocean Equity Fund does not have an objective linked to the oceans or marine bio-diversity but the Fund Manager may choose to invest in companies that derive their revenue from shipping and energy transition sectors.

AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY | MEMBER OF THE LONDON STOCK EXCHANGE | NOT FOR DISTRIBUTION IN THE U.S.A.

This factsheet has been issued by Fiske plc on the basis of publicly available information, internally developed data and other sources believed to be reliable and accurate. No representations or warranty, expressed or implied, is made nor responsibility of any kind is accepted by Fiske plc, its directors or employees either as to the accuracy or completeness of any information stated in this factsheet. Any opinions expressed (including estimates and forecasts) may be subject to change without notice. This document is not intended as an offer to buy or sell the fund nor as a personal recommendation. Fiske plc, or any of its connected or affiliated companies or their employees, may have a position or holding or other material interest in the fund concerned or in a related investment, or may have provided within the previous twelve months, significant advice or investment services in relation to the investment concerned or a related investment.

Investors must be aware of the risks associated with investment in this fund. Full details of the Ocean Equity Fund, including risk warnings, are published in the Prospectus and Key Investor Information document. The fund may not be suitable for all investors and if you are in any doubt whether the fund is suitable for you advice should be sought from a suitably qualified professional advisor. The value of the fund and the income derived from it can go down as well as up. Investors may not get back their initial investment. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realised. Securities denominated in foreign currencies may see their value fall as a result of exchange rate movements. Any comments contained in this factsheet are intended only for the use of the individual or entity to which it is addressed and may contain information which is confidential and may also be legally privileged.

If you have received this document in error, please telephone the Compliance Department on 44 (0)20-7448-4700. Fiske plc FCA Register No: 124279