Understanding vulnerability

As a trusted provider of financial services, we have a duty to assist and protect vulnerable clients. This is a brief guide to how to spot the signs and circumstances of vulnerability and what we can do to ensure the best possible outcomes in such cases.

The Financial Conduct Authority (FCA) has estimated around 50 per cent of people will find themselves in a vulnerable position at some point during their lives1. Many will be reluctant to reveal their plight, while others might not even realise they need help.

A question of financial, mental and physical health

A successful, life-long investment journey does not depend solely on a person’s financial health. It also depends on their mental and physical health, which is why financial services providers are increasingly aware of the need to help and protect vulnerable clients.

The FCA defines a “vulnerable consumer” as one whose personal circumstances leave them especially susceptible to harm, particularly when a provider is not giving them suitable levels of care2. This ties in with the FCA’s Consumer Duty standard, which requires providers to consider a customer’s characteristics, needs and goals at all times.

Some causes of vulnerability are relatively well known. They include bereavement, ill health and old age. But many others are less widely recognised – even by the people who suffer them.

The FCA’s research on this issue identifies four principal drivers of vulnerability, each comprising a number of characteristics and/or indicators. These can be organised as follows:

Health conditions

- Addiction

- Vision

- Hearing

- Mobility

- Dexterity

- Mental health

- Memory

- Learning, understanding or concentrating

- Stamina, breathing or fatigue

- Other conditions

Negative life events

- Becoming the main carer for a close family member

- Death of a parent, partner or child

- Serious illness (self or close family member)

- Loss of job

- Unwanted reduction in working hours

- Bankruptcy

- Relationship breakdown, separation or divorce

- Domestic abuse

Low financial resilience

- Difficulty in keeping up with domestic bills and/or credit commitments

- Inability to cover living expenses

- Difficulty in meeting increase in rent or mortgage

- Difficulty in paying day-to-day expenses in retirement

Low capability

- Low confidence in ability to manage money

- Limited knowledge of financial matters

- Lack of consumer confidence

- Limited access to or knowledge of internet

Sources: Financial Conduct Authority: Financial Lives Survey, 2022; Financial Conduct Authority and Critical Research: Vulnerability Review, 2024

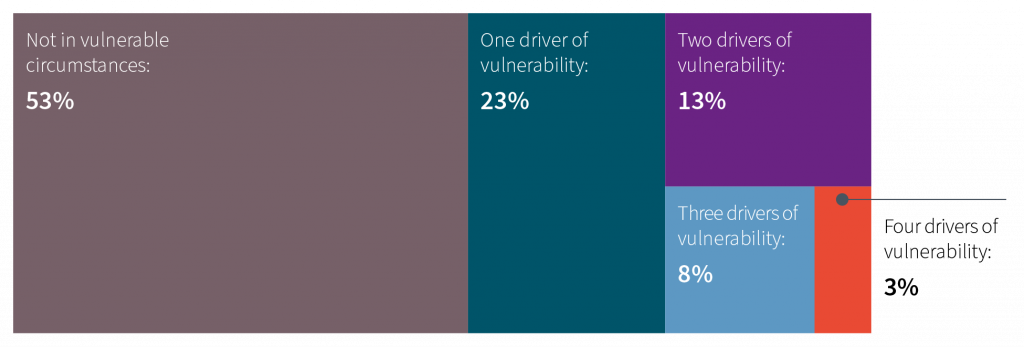

Vulnerability can be multidimensional

Published in 2024, the FCA’s Vulnerability Review interviewed 1,500 consumers and found almost half considered themselves vulnerable. Crucially, as shown below, a significant percentage reported exposure to more than one driver of vulnerability.

Source: Financial Conduct Authority and Critical Research: Vulnerability Review, 2024

The same research found consumers with multiple characteristics of vulnerability are likely to report poorer outcomes. Since these characteristics can interact, the impacts – including stress and a consequent reduction in decision-making capacity – are also likely to be greater.

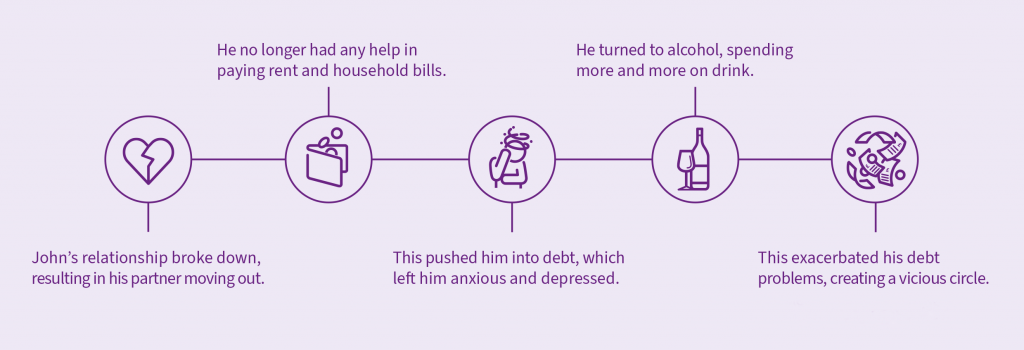

In addition, it is important to note how the drivers and characteristics of vulnerability can multiply and even become self-perpetuating. The example below illustrates the kind of negative cycle that can develop if appropriate assistance is not sought and delivered.

Note: for illustrative purposes only

Our duty to you

As the financial industry’s regulator, the FCA is giving unprecedented attention to vulnerability. In line with Consumer Duty, it is encouraging all financial services providers to improve their practices and outcomes. We welcome this development.

A key point from our perspective is that vulnerability is not a “one size fits all” problem. Some vulnerabilities are more complex than others, while many individuals might be unable or unwilling to articulate the difficulties they face.

This means we need to work closely with clients to understand and address any challenges they might be experiencing. We also need to adjust our processes and products to deliver a unique response in each instance.

The FCA’s research has shown “standardised” responses make it harder for clients to communicate and can leave them feeling their providers simply do not care. By contrast, tailored responses foster trust and are more likely to lead to positive outcomes3.

We are firmly committed to the latter approach and to helping you in any way we can. Please contact your investment manager through the usual channels if you would like to discuss this issue further.

For more information please contact your Fiske Investment Manager if you are currently a Fiske client. Alternatively, please call on +44 (0)20 7448 4700 or email support@fiskeplc.com

July 2025

- See, for example, Financial Conduct Authority and Critical Research: Vulnerability Review, 2024.

- Ibid.

- Ibid.

Fiske plc. Registered office: 100 Wood Street, London, EC2V 7AN

Member of the London Stock Exchange Authorised and Regulated by the Financial Conduct Authority

Registered in England No 02248663 VAT No. 489 1881 31

Disclaimer

This article is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Fiske plc to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. Fiske plc is authorised and regulated by the Financial Conduct Authority and is a Member of the London Stock Exchange. FCA Register No: 124279.